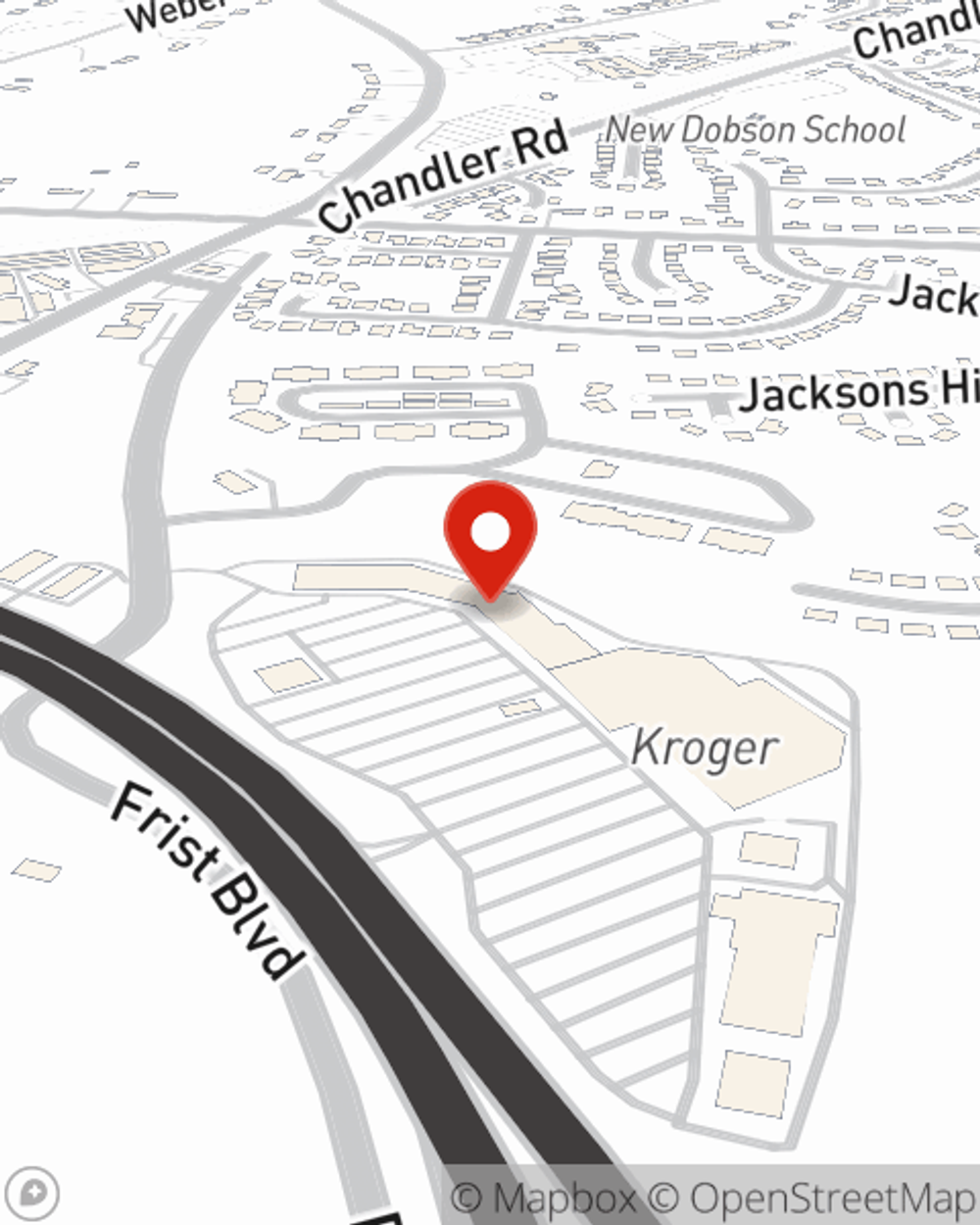

Business Insurance in and around Hermitage

One of the top small business insurance companies in Hermitage, and beyond.

Cover all the bases for your small business

- Davidson County

- Wilson County

- Williamson County

- Rutherford County

- Smith County

- Lebanon

- Nashville

- Mount Juliet

- Brentwood

- Franklin

- Madison

- Donelson

- The Gulch

- 5 Points

- Gallatin

- Hendersonville

- Goodlettsville

- Smyrna

- Spring Hill

- Nolensville

- Antioch

- Arington

Your Search For Great Small Business Insurance Ends Now.

Whether you own a a lawn care service, a cosmetic store, or a tailoring service, State Farm has small business insurance that can help. That way, amid all the various options and decisions, you can focus on what matters most.

One of the top small business insurance companies in Hermitage, and beyond.

Cover all the bases for your small business

Surprisingly Great Insurance

Your small business is unique and faces a wide array of challenges. Whether you are growing an appliance store or a vet hospital, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your location, you may need more than just business property insurance. State Farm Agent Herby Clark can help with business continuity plans as well as key employee insurance.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Herby Clark's team to discover the options specifically available to you!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Herby Clark

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.